South Africa Mining Tax: Balancing Revenue Generation and Industry Competitiveness

The taxation of the mining sector in South Africa is a critical component of the country’s fiscal framework, ensuring that the state benefits economically from its vast mineral wealth. As one of the world’s largest producers of gold, platinum group metals (PGMs), diamonds, and coal, South Africa leverages mining taxes to generate revenue for national development. However, designing a tax system that balances fair revenue generation with maintaining a competitive environment for mining companies is an ongoing challenge. In this blog post, we will explore how mining taxes work in South Africa, their economic impact, recent reforms, and the challenges of implementing these policies.

Understanding Mining Taxes in South Africa

Mining taxes in South Africa are governed by the Mineral and Petroleum Resources Royalty Act (2008) and the Income Tax Act , which together ensure that mining companies contribute fairly to the economy. These taxes include corporate income tax, royalties, and other levies designed to capture value from non-renewable resources.

Key Components of Mining Taxation

1. Corporate Income Tax

Mining companies in South Africa are subject to the standard corporate income tax rate of 27% . This applies to profits generated from mining operations after deducting allowable expenses such as exploration costs, equipment depreciation, and operational expenditures.

2. Mineral Royalties

Royalties are a critical source of revenue, calculated based on the profitability of the mine:

- For less profitable mines, the royalty rate ranges from 0.5% to 7% of gross sales.

- For highly profitable mines, the rate can increase to up to 5% of EBIT (Earnings Before Interest and Taxes) .

These rates are designed to ensure that both small-scale and large-scale miners contribute fairly while remaining viable.

3. Capital Gains Tax (CGT)

When mining companies sell assets or transfer ownership, they are subject to capital gains tax, which is included in their taxable income.

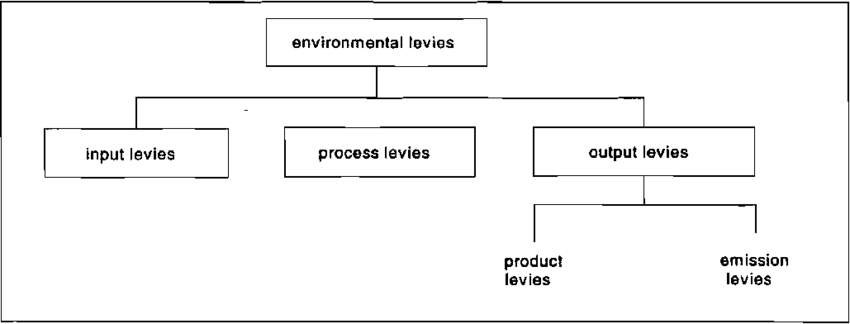

4. Environmental Levies

South Africa imposes environmental levies on mining companies to fund rehabilitation efforts and address ecological damage caused by mining activities.

5. Customs Duties and Export Taxes

Certain minerals, particularly those with strategic importance like platinum and diamonds, may be subject to export taxes or customs duties to capture additional revenue.

Economic Impact of Mining Taxes

1. Revenue Generation

Mining taxes are a significant source of revenue for South Africa’s government, contributing billions of rand annually. These funds are used to finance essential services like healthcare, education, infrastructure, and social welfare programs.

2. Supporting Local Communities

A portion of mining tax revenues is earmarked for community development projects, including schools, clinics, and roads in mining regions. This ensures that local communities benefit directly from mining activities.

3. Reducing Inequality

By redistributing mineral wealth, mining taxes help address historical inequalities and promote socio-economic development in historically disadvantaged areas.

Recent Reforms to Mining Taxes

1. Increased Rates for Strategic Minerals

In response to global demand for critical minerals, South Africa has increased royalty rates for certain strategic resources. For example:

- Platinum Group Metals (PGMs) : Higher royalties reflect their importance in catalytic converters and green technologies.

- Cobalt and Lithium : As demand for electric vehicle batteries grows, higher royalties ensure the state captures more value from these minerals.

2. Dynamic Tax Adjustments

Recent reforms allow for dynamic adjustments to tax rates based on global commodity prices. This ensures that the government benefits during periods of high mineral prices without overburdening companies during downturns.

3. Formalization of Artisanal Mining

Efforts are underway to formalize artisanal and small-scale mining (ASM) and integrate these miners into the tax system. This ensures that informal operators contribute to national revenue while operating safely and legally.

Challenges of Implementing Mining Taxes

1. Balancing Fairness and Competitiveness

High tax rates can deter investment, particularly in capital-intensive sectors like gold and deep-level mining. Striking the right balance between revenue generation and industry competitiveness remains a challenge.

2. Regulatory Uncertainty

Frequent changes to tax rates and policies create uncertainty for investors. Stability and predictability are crucial to attracting long-term investments.

3. Enforcement and Compliance

Ensuring compliance with tax regulations is difficult, particularly in remote areas or where illegal mining activities occur. Strengthening enforcement mechanisms is essential to maximizing revenue collection.

4. Economic Vulnerability

South Africa’s reliance on mining taxes makes its economy vulnerable to fluctuations in global commodity prices. Diversifying revenue streams is necessary to reduce this dependency.

Case Studies: Lessons from Mining Tax Systems

1. Democratic Republic of Congo (DRC)

The DRC increased royalties on cobalt and other strategic minerals to capture more value. While successful in generating revenue, it also highlighted the risks of abrupt policy changes deterring foreign investment.

2. Chile

Chile’s resource rent tax system ensures that highly profitable mines contribute more while providing relief to smaller operators. South Africa could adopt similar principles to enhance fairness.

3. Australia

Australia’s progressive tax system adjusts rates dynamically based on profitability and global prices. This model has been praised for balancing revenue generation with industry sustainability.

Frequently Asked Questions (FAQs)

Q1: What are mining taxes?

A1: Mining taxes are fees and levies imposed on mining companies to ensure that the state benefits economically from its mineral resources.

Q2: How are mining taxes calculated in South Africa?

A2: Mining taxes include corporate income tax (27%), mineral royalties (0.5%–7% of gross sales or up to 5% of EBIT), and environmental levies.

Q3: Do higher taxes deter investment?

A3: High tax rates can deter investment, especially in capital-intensive sectors. However, well-designed systems that balance fairness and competitiveness can attract sustainable investments.