Lithium Mineral Stocks

Lithium mineral stocks refer to shares of companies involved in the exploration, mining, and production of lithium-bearing minerals such as spodumene, lepidolite, and petalite, or in the extraction of lithium from brines and clay deposits.

With the global demand for lithium surging due to its critical role in electric vehicles (EVs), renewable energy storage, and consumer electronics, investing in lithium stocks has become a strategic move for investors looking to capitalize on the clean energy transition.

1. Top Lithium Mineral Stocks to Watch

Several companies are actively involved in lithium exploration and production, particularly in regions with rich lithium resources like Australia, South America, Canada, and the U.S.

Some of the most notable lithium mineral stocks include:

- Allkem Ltd (TSX: ALK | ASX: AKE): Merging with Orocobre to create a major lithium producer with assets in Argentina and Canada.

- Livent Corporation (NYSE: LTHM): A global lithium producer with operations in Argentina and the U.S., focused on lithium hydroxide.

- Mineral Resources Limited (ASX: MIN): A major Australian miner with exposure to lithium through the Greenbushes joint venture with Albemarle.

- Galaxy Resources (ASX: GXY): Focused on hard rock and brine lithium projects in Australia and Argentina.

- Sigma Lithium (NASDAQ: SGML): Developing high-grade lithium projects in Brazil with a focus on sustainable production.

2. Lithium Mineral Exploration Companies

In addition to producers, several junior exploration companies are positioning themselves for future growth:

- Piedmont Lithium (NASDAQ: PLL): Developing lithium projects in the U.S. Carolinas, with a focus on North American supply chain integration.

- Sayona Mining (ASX: SYA): Active in Quebec, Canada, developing spodumene-based lithium projects.

- Standard Lithium (TSX: SLL | NYSE: SLI): Focused on lithium extraction from brines in the U.S., particularly in Arkansas and California.

- Neo Lithium (TSXV: NLC | Acquired by Zijin Mining): Previously active in Argentina, now part of a larger lithium portfolio.

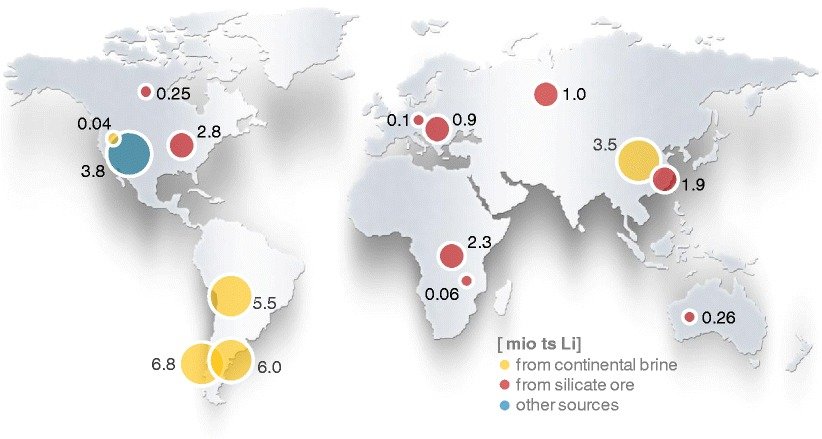

3. Key Lithium-Producing Regions

The most attractive lithium stocks are tied to companies operating in lithium-rich regions:

- Australia: World’s top hard rock lithium producer (Greenbushes, Mt Cattlin, Pilgangoora)

- Chile and Argentina: Leading brine producers in the Lithium Triangle

- North America: Growing interest in U.S. and Canadian lithium projects for EV battery supply chains

- Europe and Africa: Emerging regions with new exploration and development projects

4. Investment Considerations for Lithium Mineral Stocks

When investing in lithium stocks, consider the following factors:

- Deposit Type: Hard rock, brine, or clay—each has different production costs and timelines.

- Processing Strategy: Companies with access to refining or downstream processing may have a competitive edge.

- Geopolitical Risk: Companies operating in stable jurisdictions (e.g., Canada, Australia, U.S.) may offer more predictable returns.

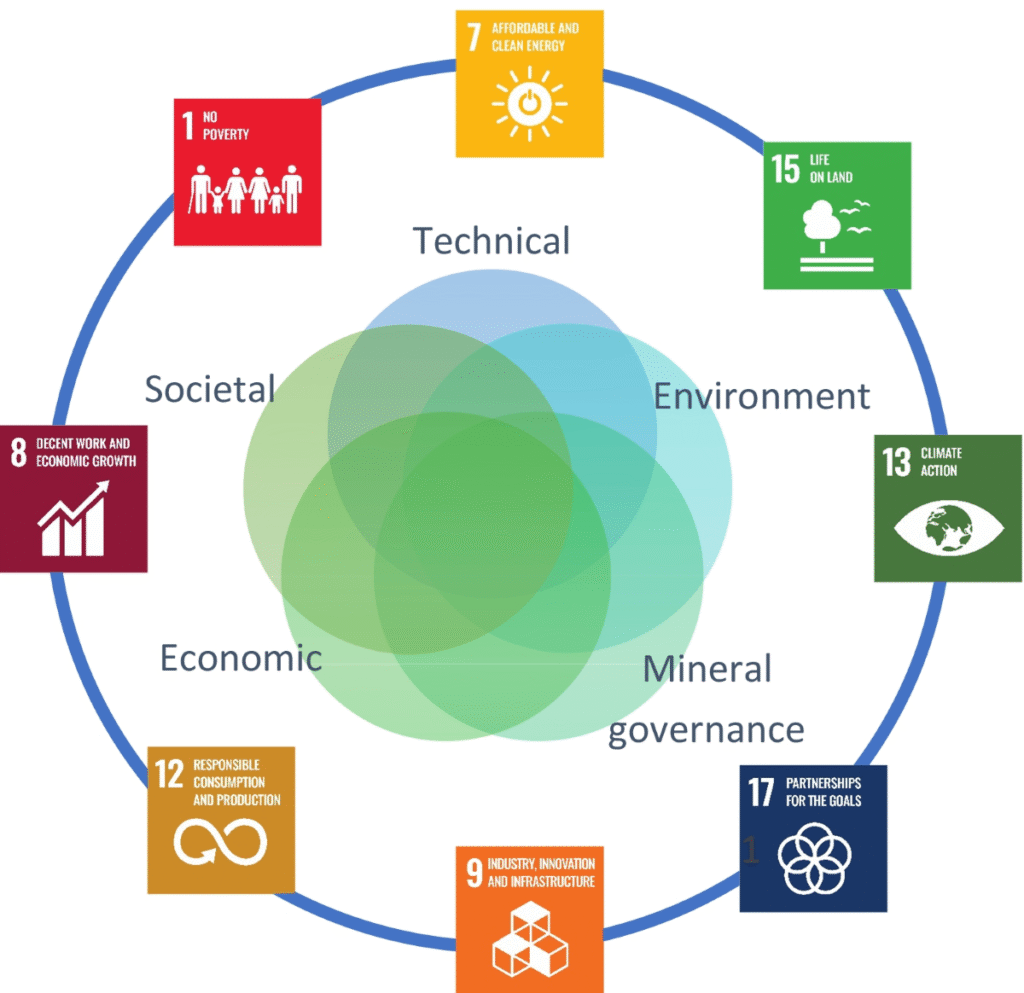

- Environmental, Social, and Governance (ESG) Factors: Sustainable and ethical lithium production is increasingly important to investors.

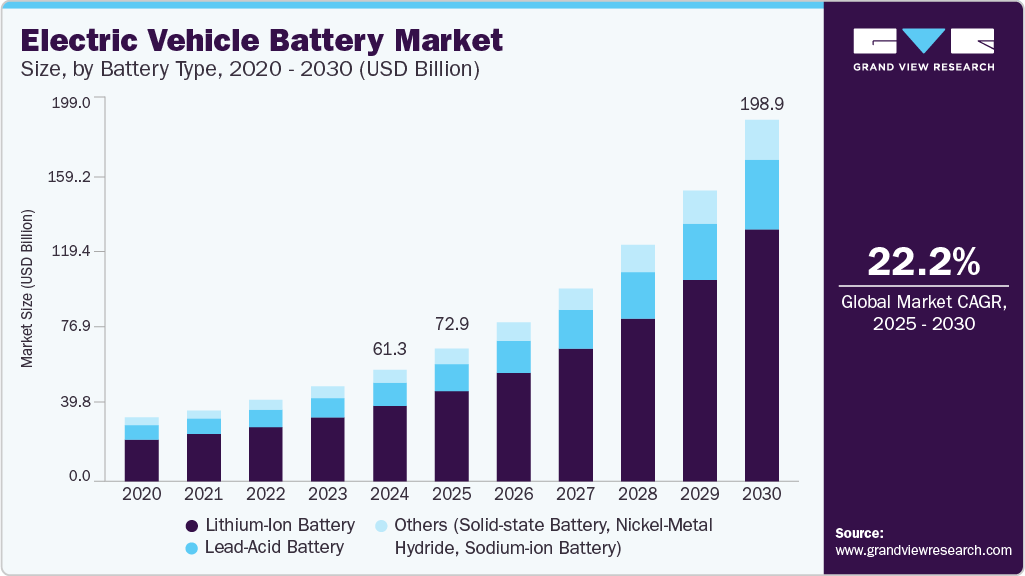

- Battery Market Trends: EV adoption and battery plant expansions directly influence lithium demand and stock performance.

5. Lithium Market Outlook and Stock Performance

The lithium market has seen significant volatility in recent years due to supply chain shifts, production cycles, and EV demand growth. However, long-term projections remain strong:

- Global lithium demand is expected to grow by over 20% annually through 2030

- EV sales are driving the need for battery-grade lithium hydroxide and carbonate

- New extraction technologies (e.g., Direct Lithium Extraction) are attracting investor interest

- Government incentives in the U.S., EU, and Asia are reshaping the investment landscape

FAQs

Q1: What are the best lithium mineral stocks to invest in?

A1: Top lithium stocks include Livent (LTHM), Albemarle (ALB), Allkem (ALK), and Galaxy Resources (GXY).

Q2: Are lithium stocks a good investment?

A2: Yes, for long-term investors, especially as EV and battery demand continues to rise. However, short-term volatility is common.

Q3: How do I invest in lithium mineral stocks?

A3: You can invest through stock exchanges like the NYSE, NASDAQ, or ASX, or through ETFs focused on battery metals and clean energy.

Conclusion

Lithium mineral stocks offer investors exposure to a rapidly growing market driven by the clean energy revolution. Whether through hard rock mining, brine extraction, or new clay-based technologies, lithium remains a cornerstone of the electric vehicle and renewable energy industries, making it a compelling sector for strategic investment.