Lithium Mineral Price Trends

The price of lithium, a critical mineral for modern technology and green energy, fluctuates based on global demand, supply chain dynamics, and geopolitical factors. As the world transitions to electric vehicles (EVs) and renewable energy storage, lithium has become one of the most sought-after commodities.

Below is a detailed look at current and historical lithium mineral prices, key market drivers, and what to expect in the near future.

1. Current Lithium Mineral Prices (2024–2025)

As of early 2025, lithium prices have seen a correction from the peak levels of 2022 but remain historically high due to sustained demand. Approximate benchmark prices are:

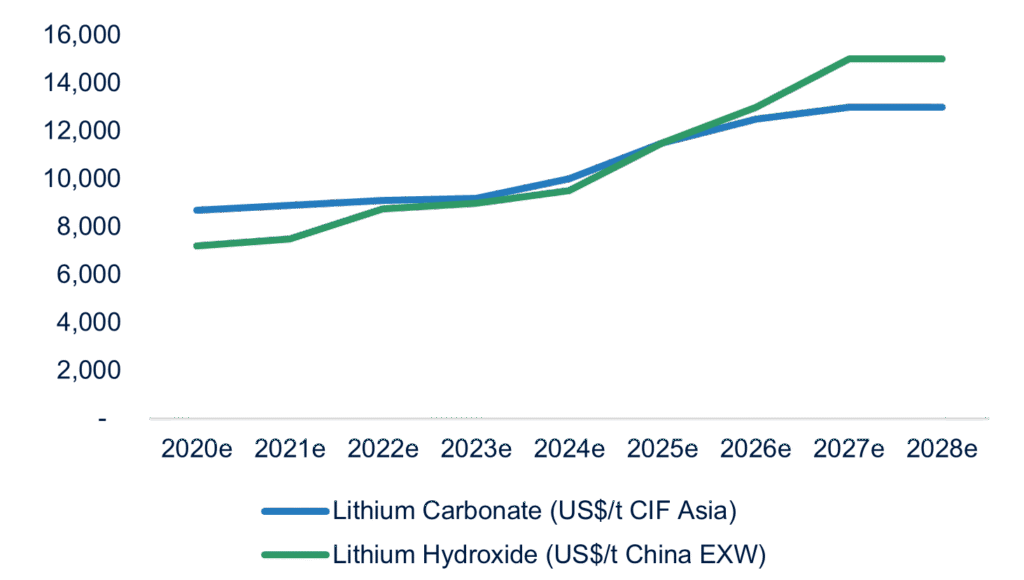

- Lithium carbonate (battery grade): $18,000–$22,000 per ton

- Lithium hydroxide (used in EV batteries): $20,000–$24,000 per ton

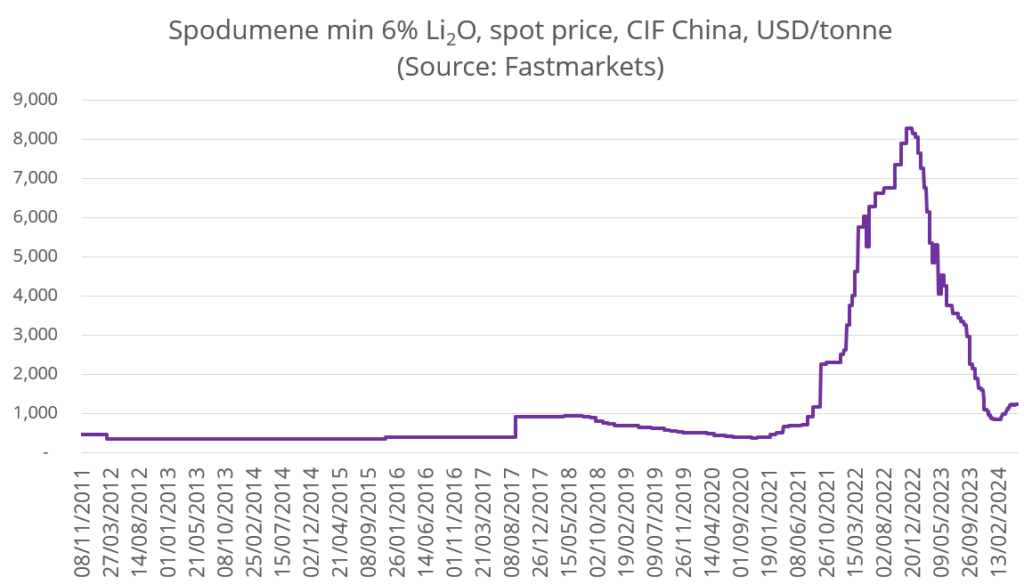

- Spodumene concentrate (6% Li₂O): $1,200–$1,600 per ton (FOB Australia)

2. Factors Influencing Lithium Prices

Several factors impact lithium pricing:

- EV Demand: The rapid growth of the electric vehicle industry is the primary driver.

- Supply Chain Disruptions: Mining delays, logistics, and geopolitical tensions affect availability.

- Production Costs: Extraction and refining costs vary by region and method.

- Government Policies: Subsidies and green energy mandates influence demand and investment.

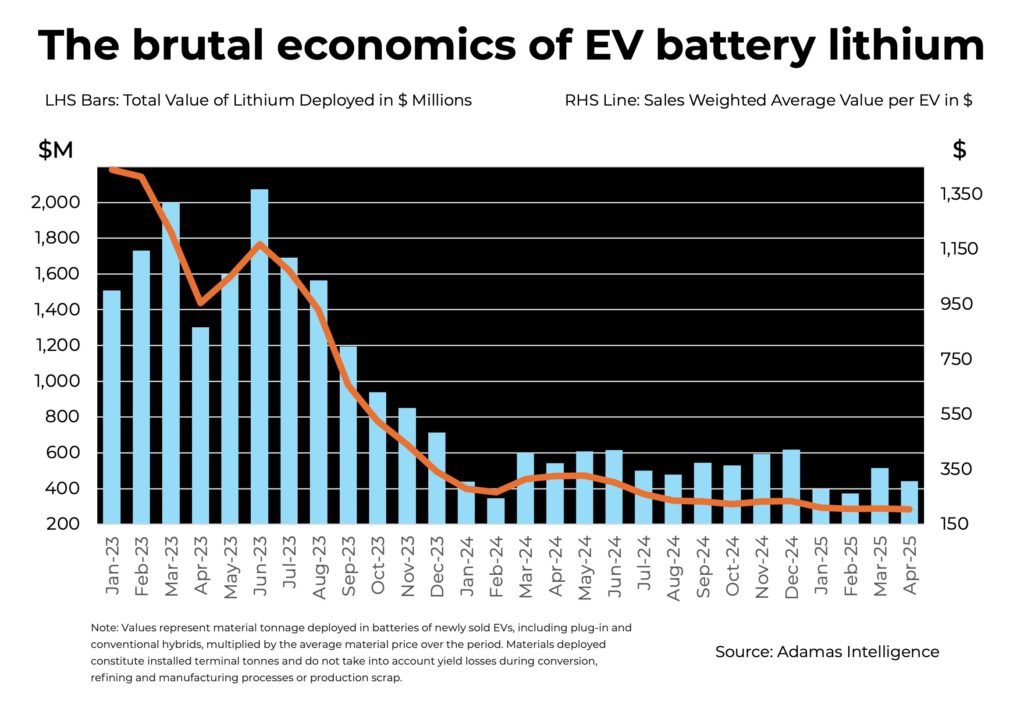

3. Historical Price Volatility

Lithium prices have been highly volatile over the past decade. In 2022, prices surged due to supply shortages and EV boom, but they dropped in 2023 as new production came online. The market is now stabilizing, with prices expected to gradually rise again.

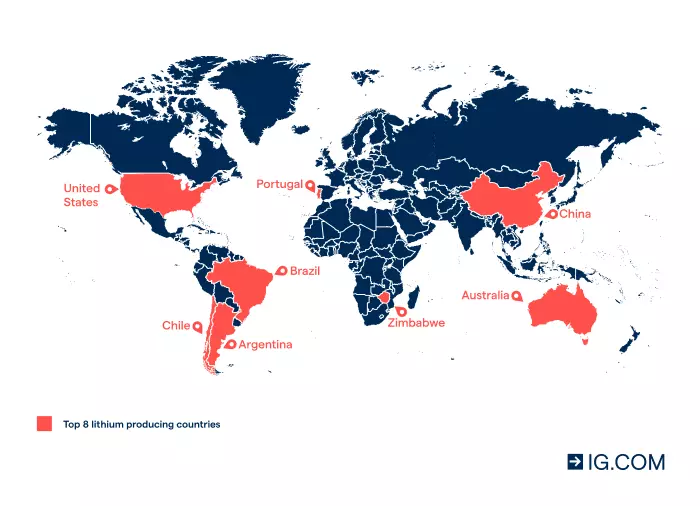

4. Major Lithium-Producing Countries

The top lithium-producing countries influence global pricing through production levels and export policies:

- Australia: Largest producer, primarily from hard rock spodumene.

- Chile and Argentina: Major brine producers in the Lithium Triangle.

- China: Dominates refining and processing of raw lithium.

- United States and Canada: Emerging producers with new projects underway.

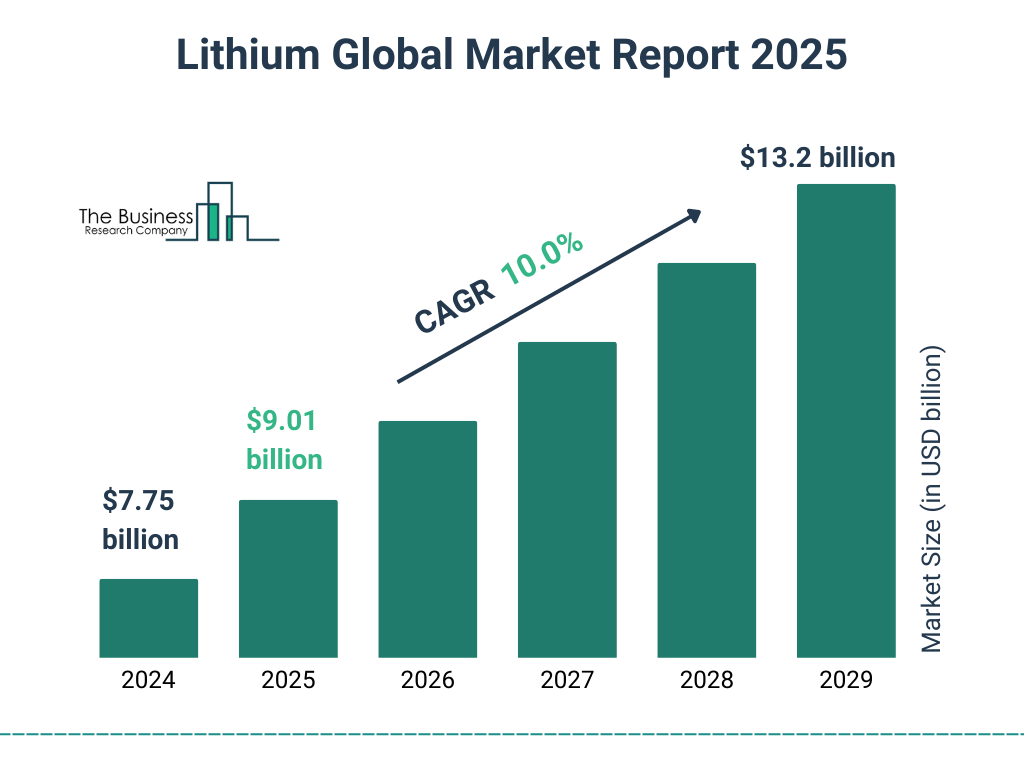

5. Future Outlook for Lithium Prices

Analysts project that lithium prices will remain strong through the 2030s due to continued EV adoption and battery manufacturing expansion. New mining projects and recycling initiatives may help stabilize prices over time, but short-term fluctuations are expected.

Q1: Why are lithium prices so high?

A1: High demand from the EV and battery industries, coupled with supply constraints, keeps prices elevated.

Q2: How often do lithium prices change?

A2: Prices can change weekly or even daily based on spot market trading, production news, and macroeconomic factors.

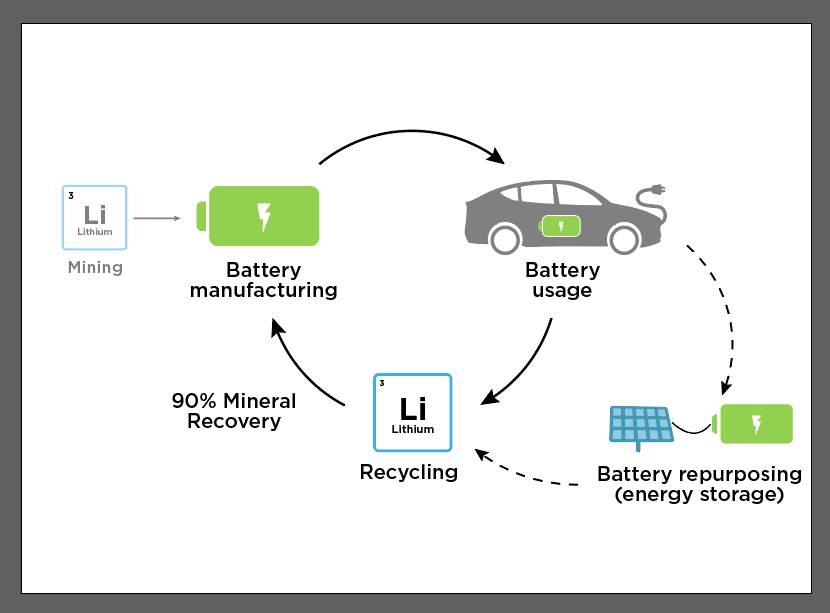

Q3: Can recycled lithium affect market prices?

A3: Yes. As lithium recycling becomes more efficient, it may help reduce demand for newly mined lithium and stabilize prices.

Conclusion

Lithium mineral prices are shaped by a complex mix of industrial demand, production challenges, and evolving energy policies. While recent years have seen volatility, the long-term outlook remains positive due to the essential role lithium plays in the global shift toward clean energy and electrification.