Industrial Minerals Trading

Industrial minerals trading is a multi-billion-dollar global industry that connects miners, processors, distributors, and end-users across construction, manufacturing, agriculture, and technology sectors. From limestone in cement plants to talc in cosmetics , these non-metallic minerals are bought and sold daily on international markets — often quietly powering modern economies.

What Is Industrial Minerals Trading?

Industrial minerals trading refers to the buying, selling, and distribution of naturally occurring non-metallic minerals used in industrial applications — not for energy or metal extraction, but for their chemical, physical, or mechanical properties .

Unlike precious metals or oil, most industrial minerals are traded via private contracts rather than on public commodity exchanges, though benchmark prices are tracked by industry analysts.

Key Commodities in Industrial Minerals Trading

| Limestone & Calcium Carbonate | Cement, paper, plastics, paints | Europe, India, China, USA |

| Talc | Cosmetics, ceramics, plastics | France (Imerys), China, India, Brazil |

| Kaolin (China Clay) | Paper coating, ceramics, rubber | USA (Georgia), UK, Brazil, China |

| Silica Sand (High-Purity) | Glass, foundry molds, fracking | USA, UAE, Australia, Egypt |

| Feldspar | Glass, ceramics, enamel | Turkey, Italy, India, China |

| Dolomite | Steelmaking, agriculture, construction | India, South Africa, Brazil |

| Barite | Oil & gas drilling fluids | China, Morocco, India, USA |

| Gypsum | Drywall, cement retarder | Spain, USA, Middle East |

These minerals are traded in various forms:

- Powdered (micronized)

- Crushed rock

- Calcined or processed grades

- Bagged or bulk (containers, railcars, ships)

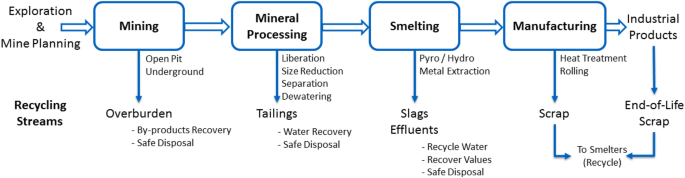

How Does the Trading Process Work?

- Sourcing : Traders connect with mining companies or processing plants in resource-rich countries.

- Quality Testing : Samples are analyzed for purity, particle size, brightness, moisture, etc.

- Contract Negotiation : Pricing based on FOB (Free On Board) or CIF (Cost, Insurance, Freight) terms.

- Logistics : Shipped via sea freight (bulk carriers or containerized), rail, or truck.

- Delivery & Certification : Buyers receive products with Certificates of Analysis (COA) and compliance documentation.

📌 Example: A trader in Singapore sources high-brightness kaolin from Brazil and sells it to a paper manufacturer in Vietnam under a 6-month supply contract.

Major Players in Industrial Minerals Trading

While many traders operate privately, some well-known names include:

| Imerys SA | France | Talc, kaolin, feldspar |

| Thiele Kaolin Company | USA | High-purity kaolin |

| Omya AG | Switzerland | Calcium carbonate, dolomite |

| BASF SE (mineral additives division) | Germany | Engineered mineral solutions |

| Minerals Technologies Inc (MTI) | USA | Specialty carbonates, bentonite |

| Private Traders & Distributors | Global | Regional supply chains in Asia, Africa, Middle East |

Many smaller trading firms act as middlemen , linking producers in Africa or Southeast Asia with manufacturers in Europe and North America.

Factors Influencing Trade & Prices

Several dynamics shape the industrial minerals market:

| 🏗️ Construction Activity | ↑ Demand for limestone, gypsum, sand |

| 🌾 Agricultural Seasons | Peak demand for lime/dolomite in spring/summer |

| ⚙️ Manufacturing Output | Drives need for fillers in plastics, paints, rubber |

| 🛥️ Shipping Costs | High freight rates affect profitability |

| 📉 Quality Standards | Premium prices for high-brightness, low-iron content |

| 🌍 Geopolitical Risks | Export bans, port delays, sanctions can disrupt supply |

Emerging Trends in 2024–2025

- Rise of ESG Compliance : Buyers demand proof of ethical sourcing and sustainable mining practices.

- Digital B2B Platforms : Alibaba, TradeKey, and Kompass are streamlining global mineral trading.

- Local Processing Hubs : Countries like India and UAE are investing in value-added mineral beneficiation.

- Circular Economy : Recycling gypsum (from drywall) and concrete aggregates is gaining traction.

Final Thoughts

Industrial minerals trading may not make headlines like oil or gold, but it’s just as vital to the global economy. Whether you’re a manufacturer sourcing raw materials , a trader building supply networks , or an investor exploring niche markets , understanding this sector opens doors to stable, high-demand opportunities.

From quarry to factory floor, industrial minerals keep industries moving — and smart trading keeps them flowing.

Frequently Asked Questions (FAQs)

Q1: Where are industrial minerals traded globally?

A: Major trading hubs include Singapore, Dubai, Rotterdam, Houston, and Mumbai , thanks to port access and logistics infrastructure.

Q2: Are industrial minerals traded on stock exchanges?

A: Not directly. However, prices are tracked by publications like Industrial Minerals Magazine and USGS reports.

Q3: How do I start trading industrial minerals?

A: Begin by connecting with suppliers, understanding quality specs, securing logistics partners, and using platforms like LinkedIn, TradeKey, or Alibaba to find buyers/sellers.