Industrial Minerals Share Price

If you’re searching for “industrial minerals share price” , it’s important to understand that there is no single stock ticker or index specifically labeled “Industrial Minerals” on major exchanges. Instead, companies involved in the production and supply of industrial minerals are typically part of larger mining, materials, or chemical conglomerates .

Why There’s No Direct “Industrial Minerals” Stock

Unlike commodities such as gold or oil, industrial minerals (like limestone, kaolin, feldspar, talc, and calcium carbonate) are generally not traded as standalone stocks. Most producers are either:

- Private companies

- Subsidiaries of larger public corporations

- Part of diversified mining or specialty chemicals groups

Therefore, investors must look at parent companies or sector-specific ETFs to gain exposure to this market.

Top Public Companies Involved in Industrial Minerals

Here are some of the leading publicly traded companies with significant industrial minerals operations:

| Imerys SA | IMT.PA(Euronext Paris) | Kaolin, talc, feldspar, calcium carbonate | France |

| Brunner Mond (Tata Chemicals Ltd) | TATAchem.BO(Bombay Stock Exchange) | Soda ash (from limestone), industrial salts | India |

| Mineral Technologies Inc (MTI) | Private (subsidiary of Iluka Resources) | Mineral processing tech & heavy mineral sands | Australia |

| Thiele Kaolin Company | Private | High-purity kaolin | USA |

| Omya AG | Private | Calcium carbonate, dolomite | Switzerland |

✅ Best Bet for Investors: Imerys SA is the only major pure-play industrial minerals company listed on a stock exchange .

Imerys SA – The Benchmark for Industrial Minerals Share Price

📈 Current Snapshot (as of latest close):

- Ticker: IMT.PA

- Exchange: Euronext Paris

- Market Cap: ~€3.5 billion

- Primary Focus: Specialty minerals including kaolin, talc, calcium carbonate, feldspar

Recent Performance Trends:

- Strong demand from paper, ceramics, plastics, and pharma sectors

- Strategic shift toward high-value specialty minerals

- Active in sustainability initiatives (e.g., carbon-neutral calcination)

📈 You can track Imerys’ share price in real time via:

- Google Finance

- Yahoo Finance – IMT.PA

- Bloomberg Terminal or Reuters Eikon

Alternative Ways to Invest in Industrial Minerals

Since most players are private, consider these indirect investment options:

1. Mining & Materials ETFs

These funds include companies involved in industrial minerals:

- iShares Global Infrastructure ETF (IGF) – Includes cement and construction material firms

- VanEck Vectors Steel ETF (SLX) – Contains companies using dolomite/limestone as flux

- SPDR S&P Metals & Mining ETF (XME) – Broad exposure to mineral producers

2. Cement & Building Materials Companies

Many use large volumes of industrial minerals:

- Holcim Ltd (

LCIN.F) – Limestone-based cement giant - CRH plc (

CRH.L) – Major user of aggregates and industrial minerals

Factors That Influence Industrial Minerals Share Prices

Even if indirectly held, the value of industrial minerals impacts stock performance through:

| 🏗️ Construction Boom | ↑ Demand for limestone, gypsum → higher revenues |

| 🌾 Agricultural Activity | ↑ Use of lime/dolomite → more sales in ag-minerals |

| ⚙️ Manufacturing Growth | ↑ Need for fillers (talc, CaCO₃) in plastics/paint |

| 🌍 Sustainability Trends | Companies investing in green processing see investor interest |

| 💸 Freight & Energy Costs | High logistics costs can reduce margins |

Final Thoughts

While there’s no direct “industrial minerals share price” ticker, investors can still gain exposure through specialty materials companies like Imerys , mining ETFs , or building materials giants . As global infrastructure and manufacturing grow, so does the hidden value of industrial minerals.

For those tracking this sector, focus on company fundamentals, end-market demand , and sustainability practices to make informed decisions.

Frequently Asked Questions (FAQs)

Q1: Is there a stock for industrial minerals?

A: Not directly. However, Imerys SA (IMT.PA) is the closest publicly traded pure-play industrial minerals company.

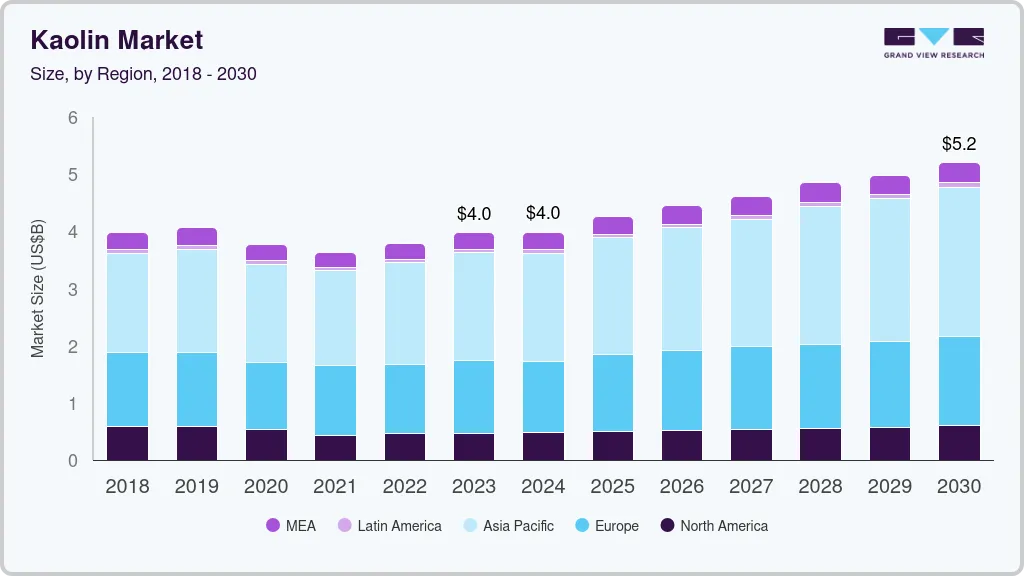

Q2: How can I invest in talc or kaolin mining stocks?

A: Invest in Imerys , or indirectly through mining/materials ETFs and diversified chemical companies.

Q3: Why are most industrial mineral companies private?

A: Many operate regionally, serve niche markets, or are divisions of larger groups, making them less likely to go public.

Final Tip:

Set up price alerts for IMT.PA on financial platforms and follow industry reports from Industrial Minerals Magazine or USGS Mineral Commodity Summaries to stay ahead of market shifts.