Industrial Minerals Prices

Understanding industrial minerals prices is essential for manufacturers, construction firms, energy companies, and suppliers who rely on these raw materials to maintain cost-effective and efficient operations.

From limestone and silica sand to barite, kaolin, and talc , prices fluctuate based on supply chain dynamics, global demand, energy costs, and regulatory changes. In this post, we break down current price trends, key influencing factors, and what to expect in the near future.

💰 Current Price Overview (2025)

While exact prices vary by region, purity grade, and volume, here are approximate bulk market ranges for major industrial minerals (FOB or delivered basis):

| Calcium Carbonate (Ground) | $50 – $120 | Plastics, paints, paper, construction |

| Precipitated Calcium Carbonate (PCC) | $200 – $400 | High-end coatings, pharmaceuticals |

| Silica Sand (Industrial Grade) | $40 – $100 | Glass, foundry, fracking, construction |

| Kaolin (Clay) | $100 – $250 | Ceramics, paper coating, rubber |

| Talc (Industrial Grade) | $150 – $350 | Plastics, cosmetics, ceramics |

| Barite (Drilling Grade) | $130 – $220 | Oil & gas drilling muds |

| Perlite (Expanded) | $300 – $600 | Insulation, horticulture, filtration |

Note: Prices are indicative and subject to change based on location, processing level, and market conditions.

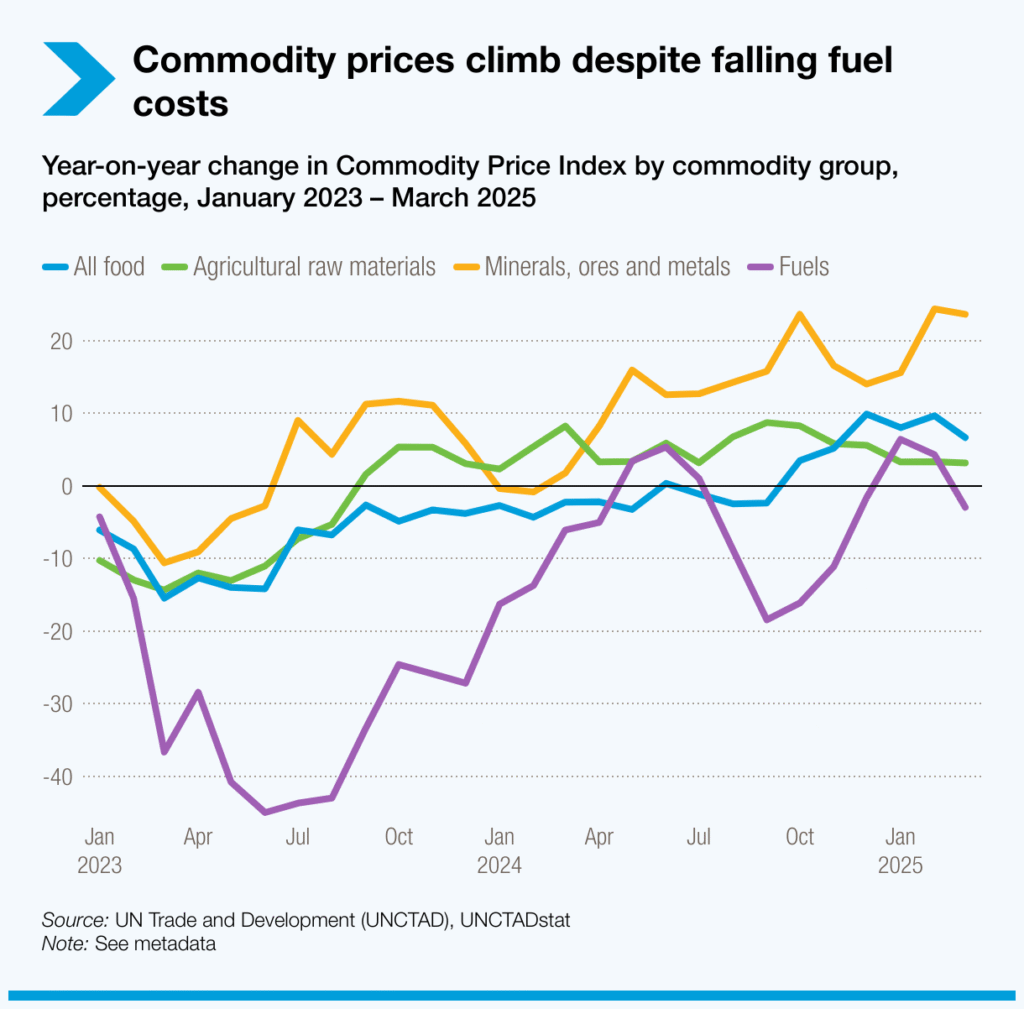

📈 Key Factors Influencing Industrial Minerals Prices

Several variables impact the cost of industrial minerals:

1. Supply Chain & Logistics

Fuel costs, port availability, and transportation bottlenecks can significantly affect final delivery prices — especially for bulk shipments.

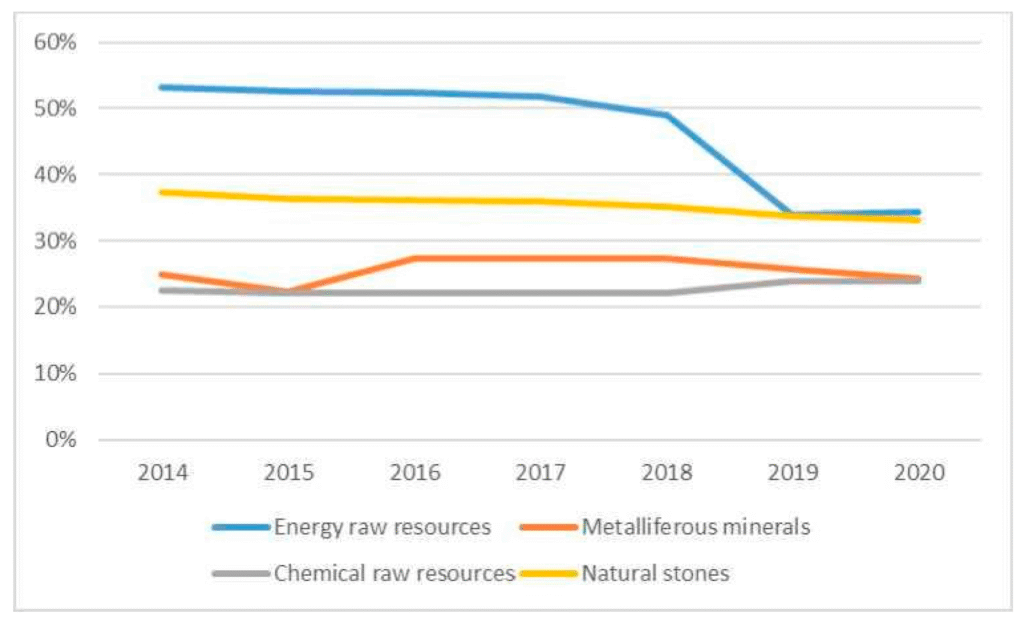

2. Energy Costs

Mineral processing (crushing, grinding, drying, calcining) is energy-intensive. Rising electricity and natural gas prices directly impact production costs.

3. Global Demand

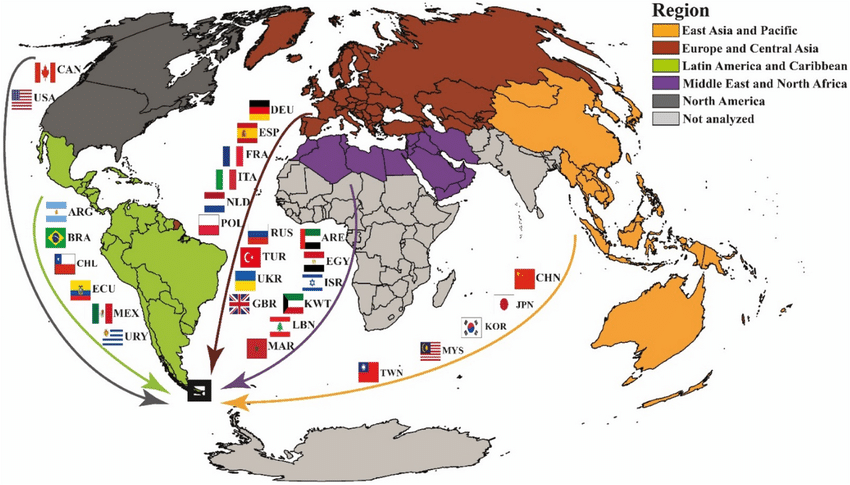

Growth in infrastructure (Asia-Pacific), oil & gas exploration, and green technologies (e.g., solar glass using silica) drives up demand — and prices.

4. Regulatory & Environmental Compliance

Stricter mining regulations and sustainability requirements may increase operational costs, which are often passed on to buyers.

5. Geopolitical Factors

Trade policies, export restrictions, and regional conflicts can disrupt supply and create price volatility.

📊 Market Outlook: What’s Next?

- Construction Boom : Increased public infrastructure spending in the U.S., India, and Europe is boosting demand for limestone and silica sand.

- Energy Sector Recovery : Renewed oil & gas activity supports stable barite prices.

- Sustainability Premium : High-purity, eco-processed minerals (e.g., low-carbon talc or reclaimed silica) may command higher prices as ESG standards grow.

Companies that lock in long-term supply agreements or source regionally are better positioned to manage price fluctuations.

❓ Frequently Asked Questions (FAQs)

Q: Why do industrial mineral prices vary so much?

A: Prices depend on mineral type, purity, processing level, location, transportation costs, and global supply-demand balance.

Q: How often do industrial mineral prices change?

A: Prices can be adjusted quarterly or annually in contracts, but spot market prices may shift monthly due to energy costs, demand spikes, or logistics issues.

Q: Where can I find real-time industrial minerals price data?

A: Reputable sources include S&P Global Commodity Insights , Fastmarkets , Argus Media , and industry reports from geological surveys and trade associations.

Final Thoughts

Staying updated on industrial minerals prices helps businesses plan budgets, optimize sourcing strategies, and remain competitive. As markets evolve with technological advances and sustainability demands, transparency and agility in procurement will be key.