Africa Mining ETF

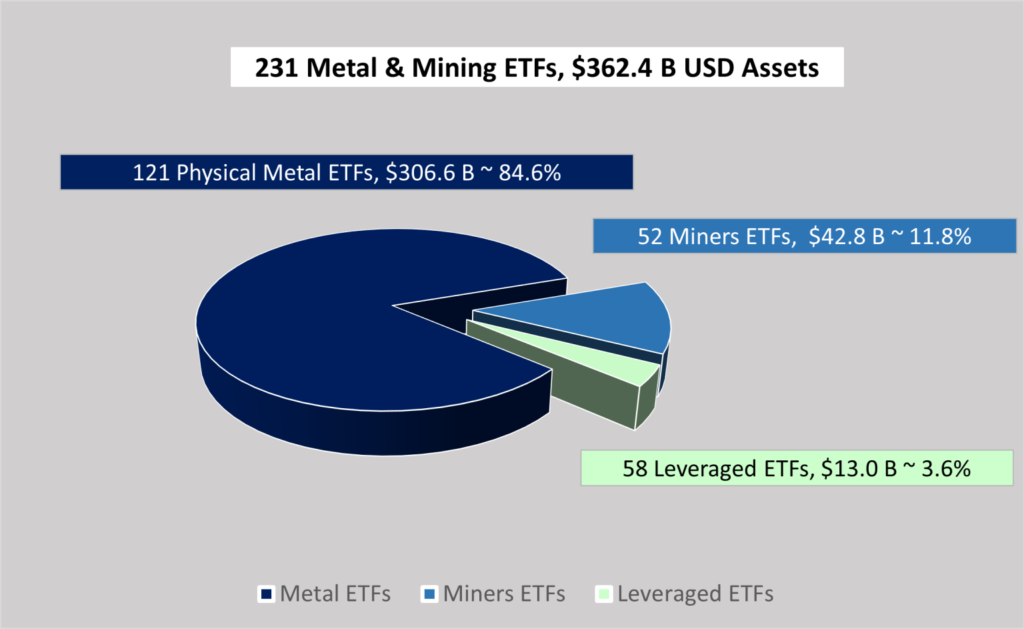

An Africa Mining ETF (Exchange-Traded Fund) is a financial instrument that tracks the performance of mining companies operating across Africa, offering investors exposure to the continent’s rich mineral resources and growing industrial demand. These funds provide a way to diversify portfolios while benefiting from the expansion of gold, lithium, cobalt, copper, and other critical minerals.

Here’s a concise overview of Africa Mining ETFs, their role, and how they reflect the continent’s evolving mining landscape.

1. What Is an Africa Mining ETF?

An Africa Mining ETF is a fund that includes stocks of mining companies primarily active in Africa, such as:

- Gold producers (e.g., AngloGold Ashanti, Gold Fields)

- Lithium and battery mineral developers (e.g., Firefinch, Allkem, Zijin Mining)

- Cobalt and copper firms (e.g., Eurasian Resources Group, CMOC)

- Diamond and PGM producers (e.g., De Beers, Sibanye-Stillwater)

These ETFs are typically listed on global stock exchanges like the ASX, TSX, and NYSE, allowing investors to access a diversified portfolio of African mining assets.

2. Benefits of Investing in an Africa Mining ETF

| Benefit | Details |

|---|---|

| Diversification | Exposure to multiple African mining sectors and countries |

| Access to Growth | Participation in Africa’s resource boom, especially for battery metals and green minerals |

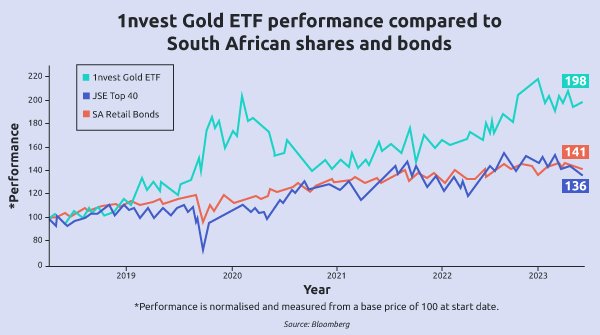

| Liquidity | Easy to trade on global markets, with real-time price tracking |

| Professional Management | Managed by experts who select top-performing African mining stocks |

| Low Entry Barriers | No need to directly invest in individual mining companies |

ETFs offer a cost-effective and strategic way to participate in Africa’s mining sector.

3. Top Africa Mining ETFs

| ETF Name | Exchange | Focus | Key Holdings |

|---|---|---|---|

| VanEck Africa Mining ETF (AFK) | NYSE | Diverse African mining stocks | Anglo American, Sibanye-Stillwater, Barrick Gold |

| Global X Africa Infrastructure & Mining ETF (AFK) | NYSE | Mining and infrastructure firms | Kumba Iron Ore, Debswana, Manganese Mining Companies |

| iShares MSCI Africa Index ETF (AFR) | NASDAQ | Broader African market, including mining firms | Includes South African and regional mining giants |

| SPDR S&P Global Mining ETF (XME) | NYSE | Global mining exposure, with some African holdings | Includes companies with operations in Zimbabwe, Ghana, and DRC |

| Bloomberg Africa Mining Index ETF | Available via various platforms | Tracks African mining performance | Focused on gold, lithium, and base metal producers |

These ETFs allow investors to benefit from Africa’s mineral wealth without direct exposure to individual projects or countries.

4. Key Minerals and Countries in the ETFs

| Mineral | Key Producers | ETF Inclusion |

|---|---|---|

| Gold | South Africa, Ghana, Mali | High representation in many ETFs |

| Lithium | Zimbabwe, Namibia, Mali | Growing interest in battery mineral-focused ETFs |

| Cobalt & Copper | DRC, Zambia | Significant weight in funds targeting energy transition materials |

| Diamonds | Botswana, Angola | Included in broader African mining indices |

| Platinum Group Metals (PGMs) | South Africa, Zimbabwe | Core holdings in several ETFs |

These ETFs reflect Africa’s diverse mineral portfolio and its strategic role in global supply chains.

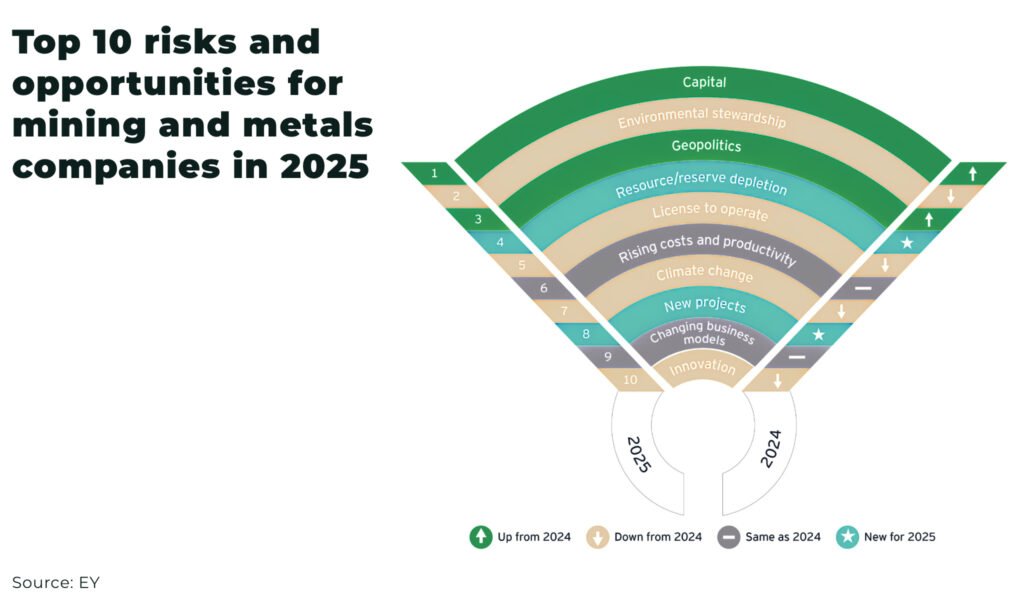

5. Risks and Considerations

Risks:

- Political instability in some African nations

- Regulatory uncertainty and policy shifts

- Currency fluctuations affecting returns

- Market volatility due to global commodity prices

Opportunities:

- Growing demand for battery minerals (lithium, cobalt, manganese)

- Improved governance and investment frameworks

- Local beneficiation and processing initiatives

- Sustainable mining and ESG compliance trends

Investors should carefully assess regulatory environments and long-term growth potential before investing.

FAQs

Q1: What is an Africa Mining ETF?

A1: It is a fund that tracks mining stocks across African countries, offering exposure to gold, lithium, and critical minerals.

Q2: Are there ETFs focused specifically on African mining?

A2: Yes—funds like AFK and AFR include significant African mining holdings.

Q3: How do I invest in an Africa Mining ETF?

A3: Through brokerage accounts on major exchanges like NYSE, NASDAQ, and ASX.

Conclusion

An Africa Mining ETF provides a strategic and accessible way to invest in one of the world’s most resource-rich regions. As demand for critical minerals grows, these funds offer diversified exposure to the continent’s mining industry.