South Africa Mining Data

South Africa remains one of the most important mining nations in Africa, with a long history of gold, platinum, and coal production. Despite challenges such as declining output and energy constraints, the sector continues to play a key role in the country’s economy.

Here’s a concise overview of South Africa mining data, including key minerals, production figures, and economic impact.

1. Key Minerals and Production (2024)

| Mineral | Annual Production (Tonnes or Carats) | Major Producers |

|---|---|---|

| Gold | ~130 tonnes | AngloGold Ashanti, Sibanye-Stillwater, Harmony Gold |

| Platinum Group Metals (PGMs) | ~600,000 kg (platinum, palladium, rhodium) | Anglo American Platinum, Sibanye-Stillwater |

| Coal | ~250 million tonnes | Exxaro Resources, Kumba Iron Ore |

| Diamonds | ~8 million carats | Debswana, Lucara Diamond |

| Manganese | ~5 million tonnes | Manganese & Iron Ore Company (MIO) |

| Chromium | ~12 million tonnes | South African Chrome Association |

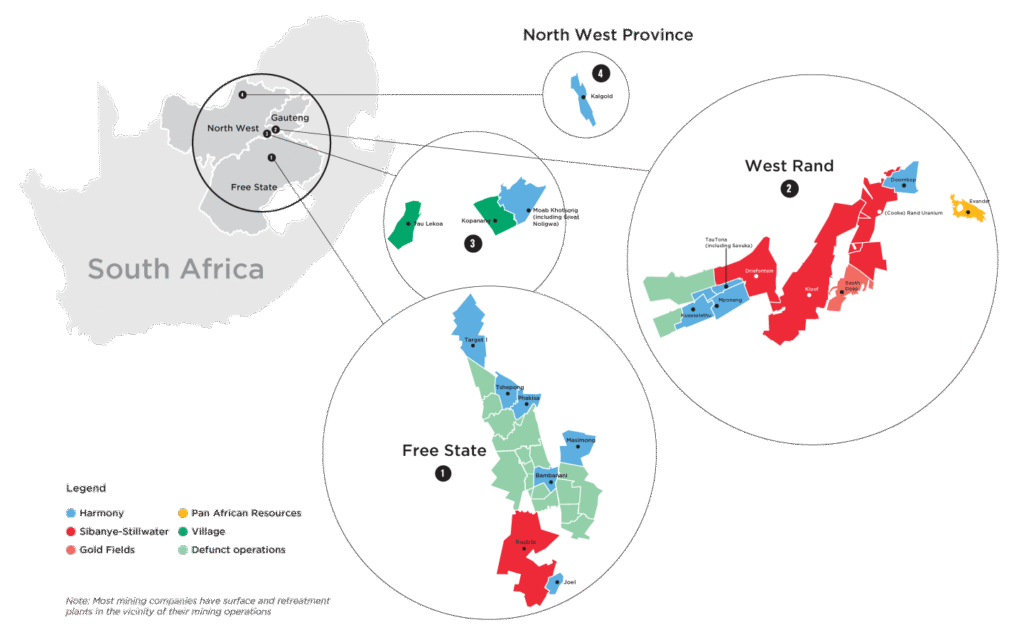

2. Major Mining Regions

- Witwatersrand Basin (Gauteng): Historic gold hub

- Bushveld Complex (Limpopo, Mpumalanga): World’s largest PGM reserves

- Mpumalanga Coalfields: Central to South Africa’s power and export economy

- Northern Cape (Karoo): Focus on diamond and manganese extraction

- North West Province: Home to gold and platinum operations

These regions are central to domestic production and global supply chains.

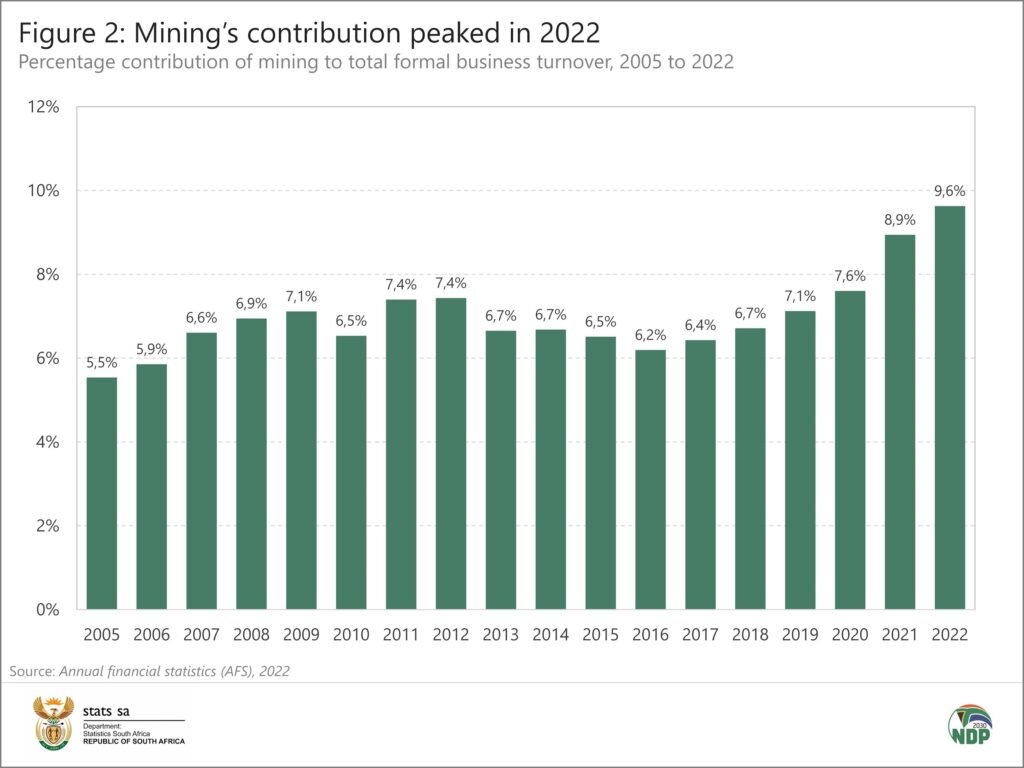

3. Economic Contribution of Mining

- Contribution to GDP: ~7–8%

- Employment: Over 450,000 direct jobs, thousands more indirectly

- Exports: Mining accounts for over 20% of total exports

- Revenue: Significant tax and royalty income for government and local communities

Despite challenges, mining remains a cornerstone of the South African economy.

4. Trends and Challenges

Trends:

- Focus on PGMs and lithium as new growth drivers

- Adoption of AI, automation, and digital tools in exploration and operations

- Energy diversification – Solar and hybrid power solutions for mines

Challenges:

- Aging infrastructure and deep-level mining costs

- Power shortages from Eskom affecting operational efficiency

- Regulatory uncertainty and policy delays

- Labor disputes and safety concerns in deep-level mines

5. Future Outlook

While South Africa mining data reflects a sector in transition, there is potential for renewed investment and innovation:

- Lithium and green minerals could drive future growth

- Local beneficiation and processing are gaining traction

- Policy reforms aimed at improving transparency and attracting FDI

- Technology upgrades to increase productivity and reduce costs

With strategic investment and regulatory clarity, South Africa can reposition itself as a leader in critical minerals and sustainable mining.

FAQs

Q1: What is the main mineral mined in South Africa?

A1: Gold and platinum group metals remain the most significant by value.

Q2: How much does mining contribute to South Africa’s economy?

A2: It contributes around 7–8% to GDP and is a top export earner.

Q3: Are there new mining projects in South Africa?

A3: Yes—especially in lithium, PGMs, and industrial minerals.

Conclusion

The South Africa mining data shows a sector in flux but still vital to the national economy. With the right policies and investments, it can adapt to global market shifts and energy transitions.