South Africa Mining Decline

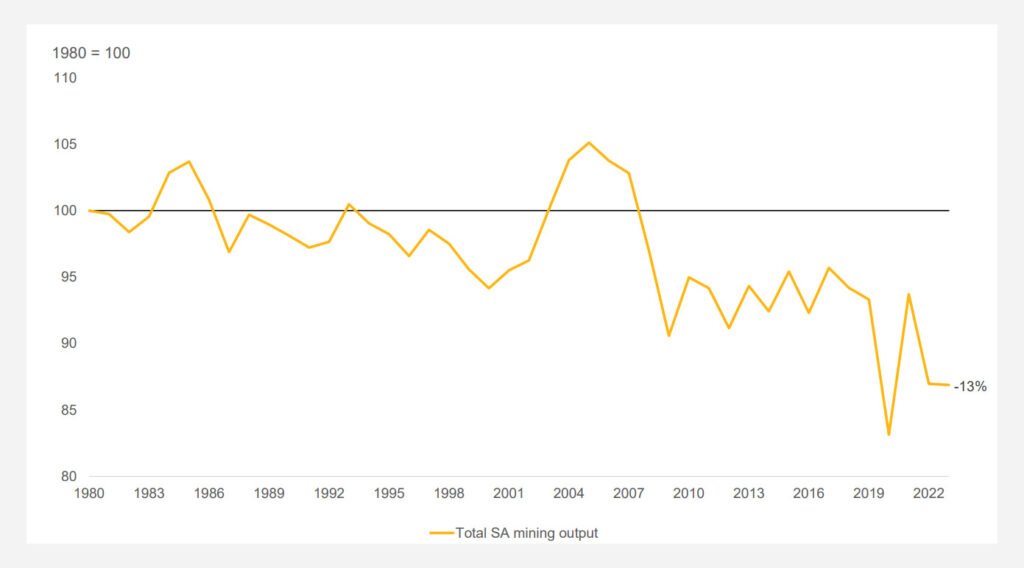

South Africa has long been a global leader in mining, with a legacy of gold, platinum, and coal that shaped its economy for over a century. However, the sector has faced declining output in recent years due to a combination of economic, technical, and policy challenges.

This decline is not just about falling production—it reflects broader shifts in global mineral markets, energy constraints, and regulatory pressures.

1. Overview of South Africa’s Mining Decline

South Africa’s mining sector has experienced long-term structural issues:

- Gold Production: Once the world’s top gold producer, it now ranks among the lower-tier producers

- Platinum Group Metals (PGMs): Still a major supplier, but output has dropped due to aging mines and operational inefficiencies

- Copper and Coal: Output remains stable, but growth is constrained by power shortages and rising costs

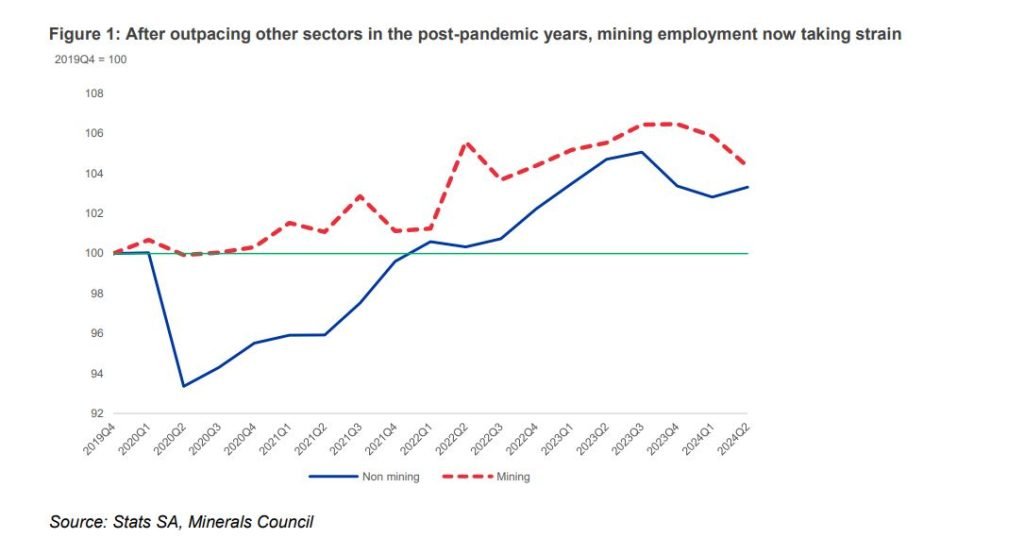

The decline has led to job losses, reduced investment, and slower economic growth in key mining regions like Witwatersrand, Bushveld, and Mpumalanga.

2. Causes of the Decline

| Factor | Impact |

|---|---|

| Aging Mines | Deep-level operations face higher costs and declining ore grades |

| Energy Crisis | Eskom load-shedding disrupts mining operations and increases costs |

| Regulatory Uncertainty | Complex licensing processes and policy changes deter investment |

| Labor Issues | Strikes, high labor costs, and poor productivity affect efficiency |

| Global Competition | Newer, lower-cost producers in Ghana, Mali, and Zimbabwe gain market share |

These factors have made it difficult for South Africa to maintain its traditional dominance in the mining sector.

3. Economic and Social Consequences

- Job Losses: Thousands of mining jobs lost in recent years

- Economic Slowdown: Reduced export earnings and investment inflows

- Regional Impact: Mining-dependent areas like Gauteng and Mpumalanga suffer from high unemployment and underdevelopment

- Revenue Shortfalls: Lower mineral output means less tax revenue for government and local communities

Despite these challenges, mining still contributes significantly to the national economy.

4. Efforts to Revive the Sector

Government and industry leaders are working on reforms and investments to reverse the decline:

- Mining Charter Reforms – Encouraging B-BBEE and local beneficiation

- Investment in New Projects – Focusing on lithium, PGMs, and green minerals

- Technology Adoption – Automation and AI to improve efficiency

- Energy Solutions – Solar and hybrid power to reduce dependency on Eskom

- Policy Stability – Streamlining licensing and reducing red tape

These efforts aim to revitalize South Africa’s mining industry and restore its position as a key player in the global mineral supply chain.

5. Future Outlook

While the South Africa mining decline presents challenges, there are opportunities for transformation:

- Lithium and PGMs could become new pillars of the industry

- Green hydrogen and clean tech may open new markets for platinum and other critical minerals

- Local beneficiation could add value and create jobs

- Private sector involvement in exploration and development is growing

However, structural reforms and energy stability will be essential for recovery.

FAQs

Q1: Why is South Africa’s mining sector declining?

A1: Due to aging infrastructure, energy shortages, regulatory uncertainty, and competition from newer producers.

Q2: Is South Africa still a major miner?

A2: Yes, but with a shift toward PGMs, lithium, and industrial minerals.

Q3: What can revive South Africa’s mining industry?

A3: Investment in technology, energy solutions, and policy reforms are key to long-term recovery.

Conclusion

The South Africa mining decline reflects broader challenges in the sector, but also highlights opportunities for transformation. With strategic investment and policy reform, the country can reposition itself as a sustainable and competitive mining nation.