Africa Mining Data

The Africa mining data landscape is a critical resource for investors, policymakers, and industry stakeholders. As one of the world’s most mineral-rich continents, Africa plays a pivotal role in global supply chains for gold, cobalt, lithium, copper, and diamonds, with ongoing exploration and development driving economic growth.

Below is a concise overview of the latest mining data from Africa, including production statistics, key players, and emerging trends.

1. Overview of African Mining Output (2024)

| Mineral | Top Producer | Annual Production (Tonnes or Carats) |

|---|---|---|

| Gold | Ghana | ~130 tonnes |

| Diamonds | Botswana | ~20 million carats |

| Cobalt | DRC | ~160,000 tonnes |

| Lithium | Zimbabwe | ~5,000 tonnes (spodumene) |

| Copper | Zambia | ~700,000 tonnes |

| Platinum Group Metals (PGMs) | South Africa | ~600,000 kg (platinum, palladium, rhodium) |

These figures underscore Africa’s importance in the global mineral economy, especially for battery materials and precious metals.

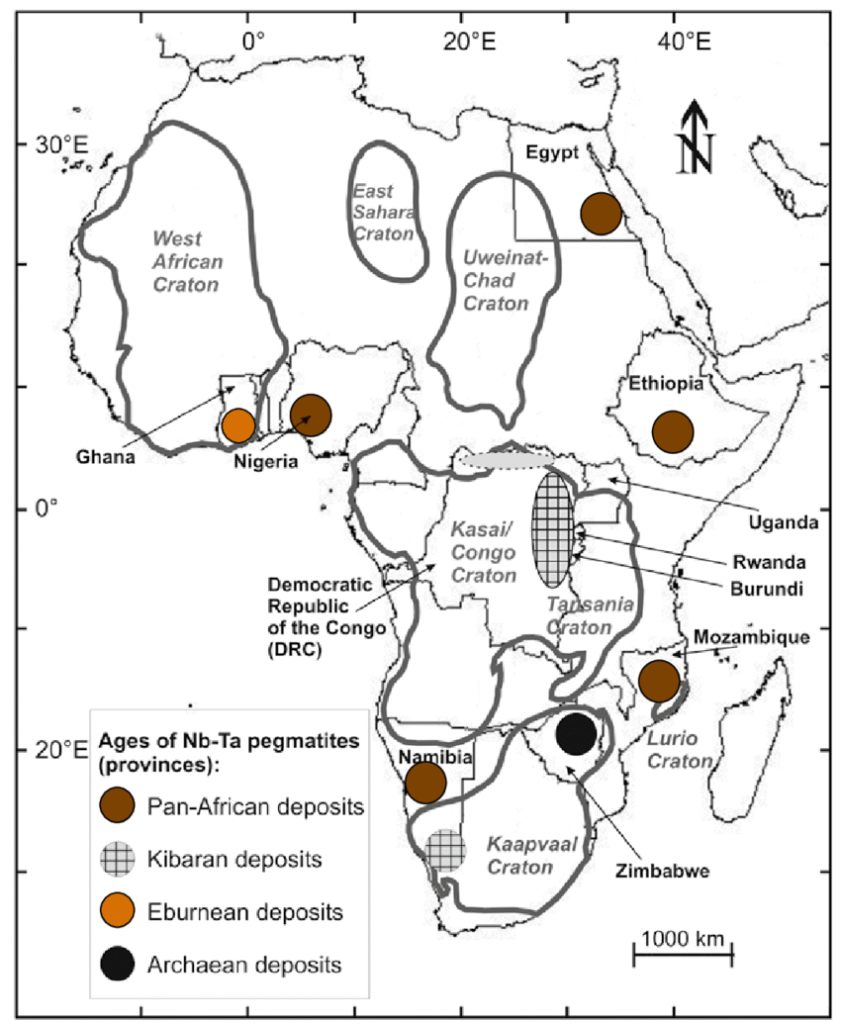

2. Major Mining Regions and Deposits

- Witwatersrand Basin (South Africa): Long-standing gold hub

- Bushveld Complex (South Africa): World’s largest PGM reserve

- DRC Copperbelt: Core of global copper and cobalt supply

- Zimbabwe Lithium Belt: Growing lithium production from spodumene deposits

- West African Gold Corridor: Ghana, Mali, Burkina Faso, and Côte d’Ivoire lead in gold output

- Northern Cape (South Africa): Major diamond and manganese regions

These areas are central to exploration, investment, and industrial growth across the continent.

3. Mining Investment and Exploration Activity

- Foreign Direct Investment (FDI): Over $10 billion invested in 2024, with significant inflows into lithium, cobalt, and gold projects

- Exploration Spend: Increased by 15% in 2024, driven by interest in battery minerals and green energy resources

- Junior Miners: A growing number of ASX and TSX-listed firms exploring in Zimbabwe, Namibia, and Mali

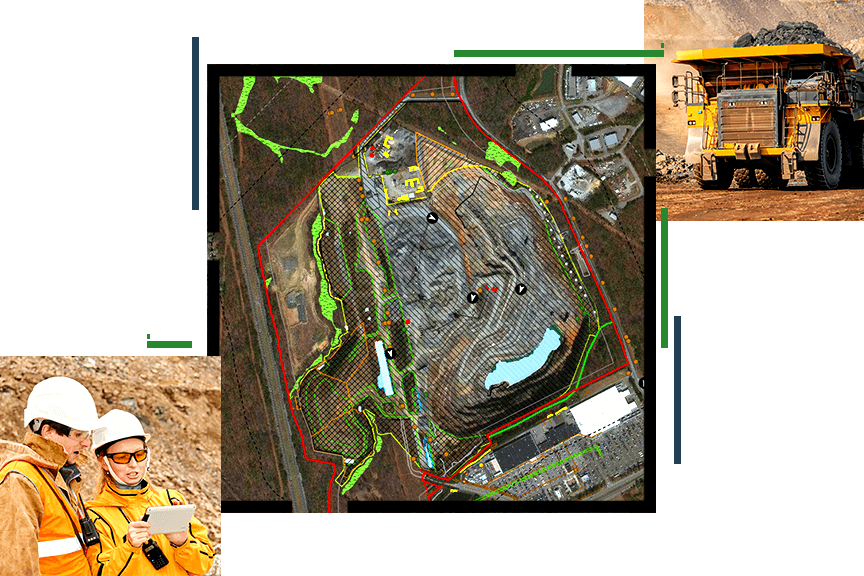

- Technology Adoption: AI, automation, and remote sensing used for resource discovery and operational efficiency

Investment is increasingly directed toward local beneficiation and sustainable practices.

4. Regulatory and Policy Environment

- Mining Laws: Many African countries have updated regulations to attract investment while ensuring transparency and ESG compliance

- B-BBEE (South Africa): Encourages local ownership and job creation

- Incentives: Tax breaks, infrastructure support, and licensing reforms in Ghana, Tanzania, and Nigeria

- Challenges: Political instability, inconsistent policies, and delays in approvals in some regions

Governments are working to improve investment climates and community engagement.

5. Environmental and Social Considerations

- Sustainability Initiatives: Increasing focus on carbon reduction, water management, and land rehabilitation

- ESG Compliance: Companies like Anglo American, Sibanye-Stillwater, and Zijin Mining are leading in responsible mining practices

- Artisanal Mining: Over 10 million people involved in informal gold and gemstone extraction

- Community Development: Mining firms invest in education, healthcare, and local procurement to build social license to operate

Balancing economic growth with environmental stewardship remains a priority.

FAQs

Q1: What are the top mining countries in Africa?

A1: Ghana, South Africa, DRC, Zimbabwe, and Botswana are among the most active in gold, diamonds, and battery minerals.

Q2: Is there a lot of lithium mining in Africa?

A2: Yes—Zimbabwe, Namibia, and Mali are emerging as key lithium producers.

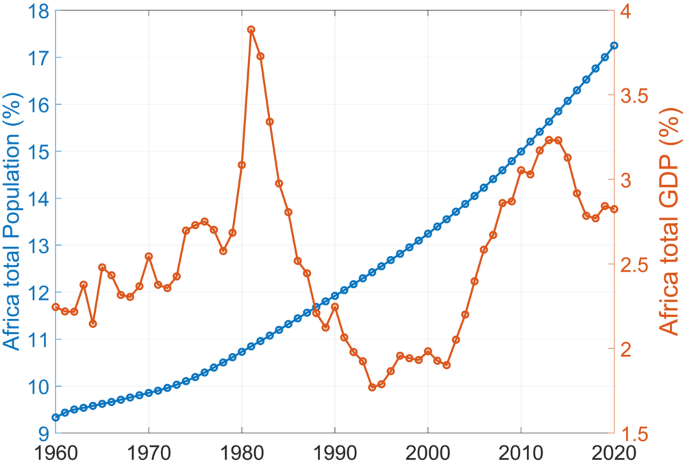

Q3: How does mining contribute to Africa’s economy?

A3: Through export revenue, employment, and infrastructure development, especially in gold, cobalt, and platinum sectors.

Conclusion

The Africa mining data reflects a sector in transformation, with increased investment, technological adoption, and regulatory reform shaping its future. As demand for critical minerals grows, Africa’s role in the global supply chain will only become more prominent.