Lithium Mineral Rights

As demand for lithium surges due to its critical role in electric vehicles (EVs), renewable energy storage, and high-tech manufacturing, understanding lithium mineral rights has become increasingly important.

Whether you’re a landowner, investor, or company, knowing who owns the rights to lithium beneath the surface—and how to legally extract and profit from it—is essential.

1. What Are Lithium Mineral Rights?

Lithium mineral rights refer to the legal ownership and control of lithium resources located beneath the surface of a property. These rights allow the holder to:

- Explore, extract, and sell lithium

- Lease the rights to mining companies

- Receive royalties from lithium production

These rights are typically separate from surface rights, meaning a landowner may own the surface but not the minerals below—or vice versa.

2. Who Owns the Lithium Mineral Rights?

Ownership of lithium mineral rights depends on geographic location and local property laws, but generally follows these patterns:

- Private Landowners: In many regions (especially in the U.S.), mineral rights are owned by the landowner unless they were previously sold or severed.

- Government-Owned Lands: On public or federal land, mineral rights are typically owned by the state or national government.

- Oil and Gas Companies: In areas with existing mineral leases (e.g., Texas, Arkansas), lithium rights may be included in broader mineral rights agreements.

- Mining Companies or Investors: Mineral rights can be leased or purchased by companies for exploration and production.

3. How Are Lithium Mineral Rights Leased or Acquired?

Companies seeking to extract lithium typically negotiate with mineral rights holders through:

- Mineral Leases: Contracts that grant the company the right to explore and extract lithium in exchange for signing bonuses and royalties.

- Royalty Agreements: Landowners receive a percentage of revenue from lithium production.

- Joint Ventures: Some landowners partner with companies for shared ownership and profits.

- Direct Sales: In some cases, mineral rights are sold outright for a lump sum.

These agreements should be reviewed by a qualified attorney or mineral rights expert to ensure fair compensation and legal clarity.

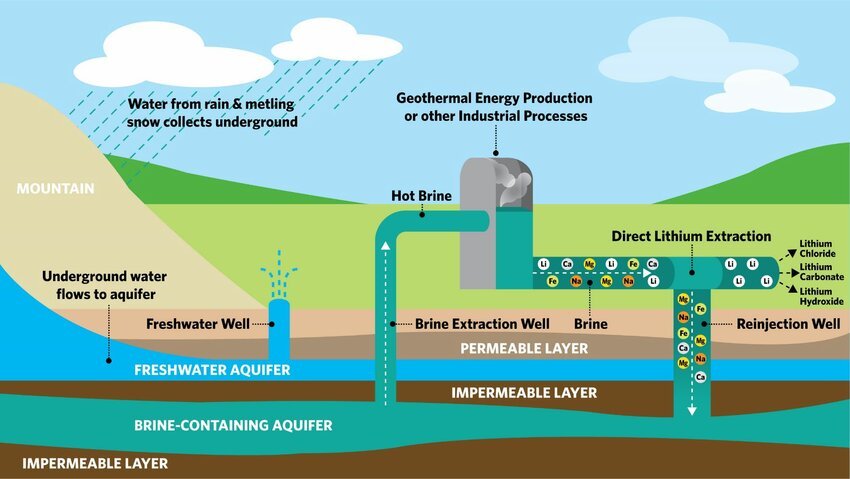

4. Lithium and Brine Rights in the U.S.

In the U.S., lithium is often extracted from brines (salt-rich waters) or clay deposits, and rights may be governed differently than traditional hard rock mining:

- Brine extraction: Involves pumping lithium-rich water from underground aquifers

- Clay and oilfield brine rights: May be included in existing mineral leases or negotiated separately

- Direct Lithium Extraction (DLE): A newer method that may influence how lithium rights are defined and managed

In states like Arkansas, Texas, and California, lithium rights are increasingly being negotiated independently from oil and gas rights.

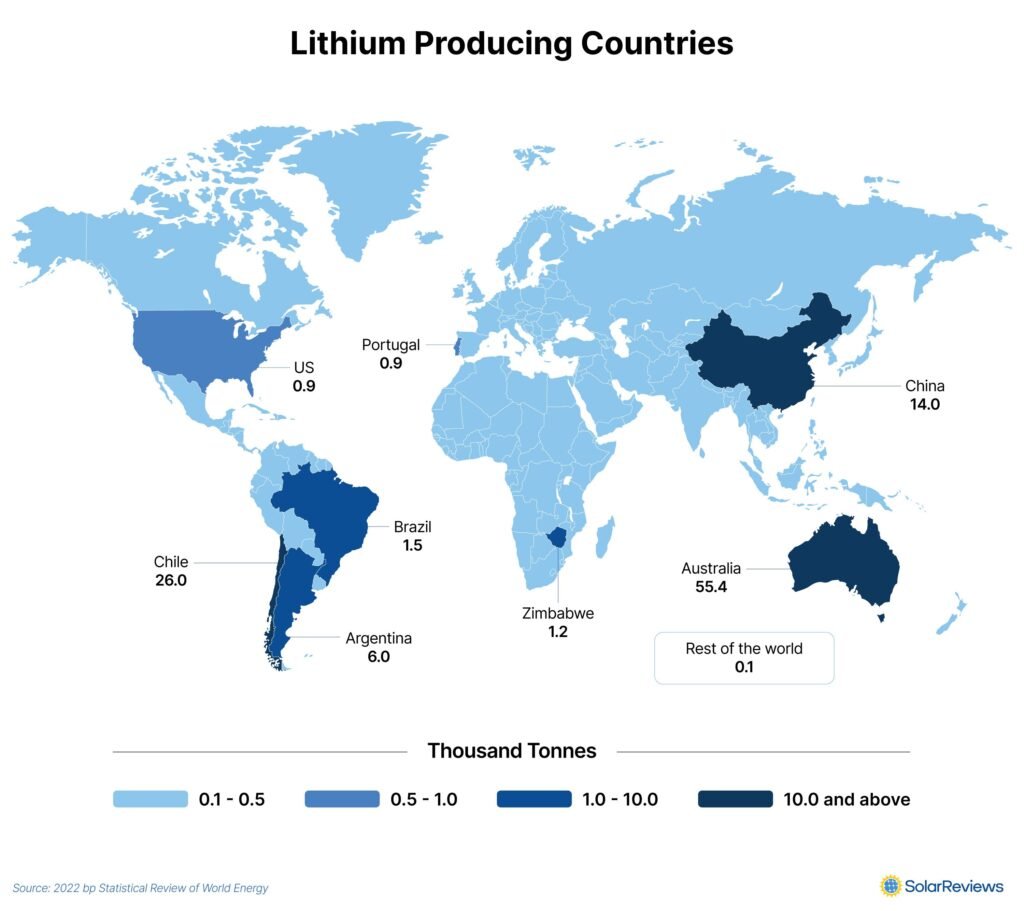

5. Lithium Mineral Rights Around the World

Different countries have different systems for managing mineral rights:

- United States: Private ownership is common, especially in states like Nevada, Texas, and North Carolina.

- Australia: Most mineral rights are owned by the state, with exploration licenses issued to companies.

- Canada: Mineral rights are generally owned by the provincial government, with companies bidding for exploration permits.

- Chile and Argentina: Lithium is considered a strategic resource, and rights are tightly controlled by the national government.

- Europe (e.g., Germany, Serbia): Lithium rights are state-managed, with companies required to apply for exploration and production licenses.

6. Why Lithium Mineral Rights Matter

Lithium mineral rights are becoming more valuable as:

- EV demand drives lithium prices higher

- Governments classify lithium as a critical mineral

- New extraction technologies (like DLE) make lithium recovery more efficient

- Local communities and landowners seek economic benefits from lithium development

Understanding and managing these rights is crucial for profit, legal compliance, and long-term sustainability.

FAQs

Q1: Who owns the lithium mineral rights?

A1: It depends on location. In the U.S., private landowners may own the rights unless previously sold. In many other countries, rights are state-controlled.

Q2: Can lithium rights be leased separately from oil and gas?

A2: Yes. In areas with lithium-rich brines (e.g., Arkansas, Texas), companies are increasingly leasing lithium rights independently.

Q3: How do I find out if I own lithium mineral rights?

A3: Review your property deed or title with a mineral rights attorney to determine if mineral rights were reserved or severed.

Conclusion

Lithium mineral rights are a growing area of interest as the world transitions to clean energy and battery-powered technologies. Whether you’re a landowner, investor, or company, understanding who owns the rights and how they can be monetized is key to participating in the lithium economy.

As lithium becomes more valuable, managing and negotiating mineral rights will be essential for economic development, legal protection, and sustainable resource use.